Which Is Better: Spending Less or Earning More?

Believe it or not, there has been a trend over the past year among personal finance bloggers. They have been rebutting the traditional “spend less than you make” advice for frugal bugdeters. Instead, they have proclaimed that it is more important to “earn more than you spend”. Some bloggers have gone so far as to equate these two maxims in order to justify the change in their message. But there are in fact significant differences between these two philosophies, and I am concerned that people may make poor budgeting decisions by listening to the latest fashion in personal financial advice. Let me explain in detail why I continue to believe in “Spending Less Than You Earn” as the best means of improving your financial situation.

Believe it or not, there has been a trend over the past year among personal finance bloggers. They have been rebutting the traditional “spend less than you make” advice for frugal bugdeters. Instead, they have proclaimed that it is more important to “earn more than you spend”. Some bloggers have gone so far as to equate these two maxims in order to justify the change in their message. But there are in fact significant differences between these two philosophies, and I am concerned that people may make poor budgeting decisions by listening to the latest fashion in personal financial advice. Let me explain in detail why I continue to believe in “Spending Less Than You Earn” as the best means of improving your financial situation.

Benefits of Spend Less Than You Earn

You cannot change your income overnight. Yes, you can sell off assets but selling assets is not a real income because sooner or later you run out of outsets. All you are doing is converting hard assets (vehicles, furniture, land, etc.) into cash. If you don’t need these things you should probably sell them anyway, but you are not increasing your income by just selling assets.

Now, if you take the money you get from selling those assets and use it to buy more assets that either produce income or which you can sell for more than you paid (including shipping and repair costs) then THAT is a way to increase your income.

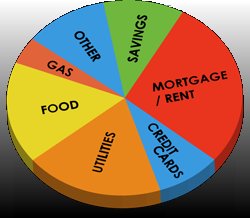

But at any income level you should always live on a budget that meets your basic needs first and only elevates the quality of your lifestyle at a slower rate than your income increases. By saving money you create cash reserves for yourself and your family that you can use later on to take care of emergencies or to create new sources of income.

Saving must come first and it should always be a priority in your life. Spending all the money you bring home because you can earn more is very short-sighted and self-defeating. You don’t know what the future will bring.

Risks of Earning More Than You Spend

Although this sounds like a great idea, there are several problems with it.

First, you can’t guarantee yourself an increase in income no matter what you do. That said, you should try to earn more money to improve your life and build your personal wealth. But you are not entitled to more income. It doesn’t come so easily for most people. Be realistic.

Second, anyone can take that money away from you. They can rob you, injure you, fire you, trick you into wasting your money, or raise your obligations to them once they learn about your new-found income. Some lenders do have this authority if you have been making payments on a special low-income plan.

Third, if you automatically adjust your lifestyle spending upward every time you get a raise or start making new money on the side, you make it that much more difficult to maintain your lifestyle when financial disaster strikes. I’m not saying you should live in an impoverished lifestyle. But it is prudent to plan for the unexpected downturns of the future. Your employer may go out of business or sell out to another company that decides it doesn’t need you. You could become catastrophically ill.

So merely earning more today doesn’t mean your wealth will continue to grow tomorrow.

You Should Always Combine Spending Less with Earning More

Taking a higher-paying job is an opportunity for you to improve your lifestyle SLIGHTLY while increasing your savings and wealth creation MORE. A good rule of thumb is to give your lifestyle a half-raise increase so that you can bank the rest of that take-home pay.

But some frugal money-managers actually don’t use their new income for lifestyle changes. Instead, they invest all their new revenue into wealth creation, thus improving their emergency funding and their plans for retirement.

Just because you can earn more today doesn’t mean you should start spending more, even if you continue to spend less then you earn. You want to increase your spending only when it makes sense to do so. Whether you take on new debt or buy assets like furniture, artwork, clothing, etc. you should always be sure that there is a long-term gain in your savings rate that at least matches your increase in earned income. It would be better to keep your asset growth at a lower pace than your earnings growth.

No matter how much money you earn, if you don’t carry your “Spend Less Than You Earn” philosophy forward in your life, you will always be struggling to make financial ends meet.