How to Stretch Your Budget While Paying Bills on Time

It happens to all of us sooner or later. We fall behind in our monthly bills because of some unexpected expense. I had a friend whose heat pump froze up one summer. It had just gone out of warranty and he had to pay $1500 out of pocket to repair the unit. But 2 weeks later it died completely and he had to buy an entirely new heat pump. OUCH!

It happens to all of us sooner or later. We fall behind in our monthly bills because of some unexpected expense. I had a friend whose heat pump froze up one summer. It had just gone out of warranty and he had to pay $1500 out of pocket to repair the unit. But 2 weeks later it died completely and he had to buy an entirely new heat pump. OUCH!

Needless to say he had to scramble to pay his bills and that was a rough period for him. I knew someone at work who had an unexpected medical expense. She needed surgery that could not be put off. Of course, the hospital and the surgeon billed her on a monthly basis (for costs not covered by insurance) but those were expenses that she had not budgeted for. Paying her bills on time became more challenging.

An unexpected car repair, or an emergency trip to see your family, or a funeral — almost anything can knock your household budget on its back and keep it there for months. You wonder if you should try to get an emergency loan (often called a “payday loan”) to catch up on the bills, but then you have to pay extra fees and you have even less money to spend out of your next paycheck.

When I was in school I learned to stretch my budget with a simple but risky trick. After about a year I caught up on my bills and I realized that my trick had cost me extra money. Nonetheless, if I were in that same position I would do it all over again. Why? Because ultimately I met my obligations and took care of my needs and didn’t have to go begging anyone for money.

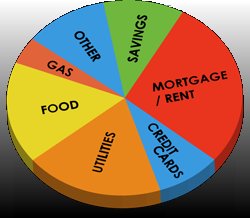

But I DID have to borrow money. You see, I used my credit card to pay my bills. I was able to do this because A) I had a high enough credit limit that I could cover the bills that were payable by credit card and B) I paid the credit card before the bills came do.

When you carry a balance on a credit card you need to figure at least the minimum monthly payment into your budget. Of course, making only the minimum payment on any credit card balance is a bad idea. You end up paying the bank a LOT of interest. So when I run up a balance on my credit card I work to pay it down as quickly as possible. But in a tight month you can’t pay it off, unless you don’t pay your other bills.

It was that logical conundrum that helped me get through my tough time. I had a job but I wasn’t about to get a raise any time soon. The only way I could keep my credit card was to make minimum payments on it every month. Those minimum payments were agonizing for me because the balance barely moved down. And as my other bills mounted up I began to resent having that credit card. Sure, I had used it to eat at restaurants, go see movies, and do other fun things, but now I was paying the piper.

So one month as I sat at the kitchen table trying to figure out how to schedule my bill payments on a student’s monthly income I said out loud, “God! I wish I didn’t have to pay that credit card bill! I could sure use the money elsewhere.”

And that’s when it hit me! I could use that money elsewhere. All I had to do was pay the credit card first and then use the card to pay another bill. You see, what this did was allow me to combine two payments into one. It didn’t reduce my debt but it did improve my cash flow. I didn’t know I was managing cash flow back then but I understand it now.

When you are in control of your cash flow you can plan ahead and avoid all sorts of little fees that eat away at your money. So I drew a deep breath, wrote a big check to the bank, and mailed it off the next day. A week later I called the bank to check my balance and the payment had cleared. I then proceeded to pay several other bills on time.

That one brave decision bought me enough time to get my budget back on track. In fact, I was able to avoid some late fees that had become a regular thing in my budget, so the next month I made an even larger payment on the credit card and paid off a couple of small debts. What a feeling of relief and power I had!

Now I was on to something, I thought. I could just use this credit card to pay all my bills! My problems were solved!

Okay, that promise didn’t last very long. A few months later I found myself needing to apply for credit (another card). I wanted to make a big trip the next year and I figured out that I could pay for it on another credit card. Yeah, this is how we all get started down that deep, dark path of financial indebtedness. So I applied for a card and was turned down.

I was crestfallen. I was upset. What happened? I was paying my bills on time, right? I asked my father why he thought I was turned down. He asked me to go over my budget with him. It took him all of two minutes to spot my problem. “Uh oh,” he said. “You’ve got a high balance on your credit card.”

Yeah, dad, but I was using it to pay my bills. “That is why the bank turned you down,” he explained. “They don’t see you managing your credit very well. It’s great that you have paid your bills on time, but you’re borrowing money to do that. When will you pay off this card?”

I had to think about that. I really had no plan to pay off the card. I was using it as a free loan to stay ahead on my bills. And the truth is that I had reduced my monthly expenses. But instead of paying down the credit card balance I just spent the money on other things. Young people do that, you know? So my dad and I went through all my credit card statements and he showed me all the extra interest I was paying on my bills.

OUCH! I thought I was saving money with that credit card but I could have saved a lot more!

So the lesson I learned that day was that, yes, you CAN use a credit card to help yourself when you fall behind on your bills. But you still need to pay off the card and keep the balance as low as possible, especially if you plan to apply for more credit in the future. I had to cancel my trip plans that year but with my dad’s patient help I worked out a new budget that paid off the credit card by the end of the year. And I also started paying my bills directly again.

So while I am glad I was able to use the credit card when I fell behind, I learned that it’s not miracle money. It’s just another tool in your financial work shed. I have never forgotten that lesson.