Tiny Budgeting: Why You Should Use Credit Cards to Pay Your Bills

If you have not read my Introduction to Tiny Budgeting, go read that article now. You need to understand what Tiny Budgeting is and how it works before you read this article.

Your goal with Tiny Budgeting is to live as inexpensively as possible without sacrificing the quality of life that you need. You don’t want to risk your family’s health or well-being in the name of saving money.

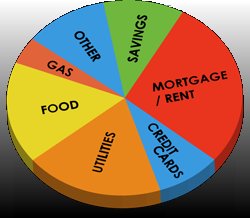

We use Tiny Budgeting to control our UMEs — our Unavoidable Monthly Expenses. But there is another side to Tiny Budgeting, and that is the side that deals with all Other Expenses. If it’s not a UME then it’s an Other Expense no matter how important it is to your household’s well-being.

Credit cards are the bane of our financial independence. We need credit cards for many reasons but the last thing you want to do is carry a balance on your credit cards. That monthly balance means you’re paying interest on things you purchased or paid for. Even if you got a great deal at the time, the interest drives up the cost of everything you pay for with the credit card.

So let’s look at the benefits of using credit cards to pay bills and then talk about why you would do this.

Benefits of Using Credit Cards to Pay Your Bills

Using a credit card to pay a bill helps you ensure you pay the bill on time. The only thing worse than paying interest on a credit card is paying a late fee or return check fee for a monthly bill. Those fees can cost you $30-40 for each instance. If your bill is only $100 or even $200 a month and you are hit with a $30 late fee, you’re paying a lot more money than you would if you had just paid with a credit card.

Credit cards give you some small control over your cash flow. The problem with credit cards is that they are not free. Because they charge interest and late fees credit cards make everything more expensive. Even so, if you don’t have the cash to pay a bill on time but you can pay it with a credit card, do that. It will save you money.

It’s obvious that your credit card balance increases every time you use it. The higher that balance goes the more interest you will be charged. But when you don’t have enough cash to pay all your bills on time you can use the credit card option to get rid of one or more monthly payments.

Let’s say you have 3 monthly bills you can pay with your credit card:

- Electricity ($120 per month)

- Sewage ($20 per month)

- Water ($30 per month)

These are UMEs but you might have some other bills. Use the credit card to make these three payments. Now you have to pay the $170 to your credit card bank. If you are carrying a balance on the card you’ll need to pay at least the scheduled minimum balance. But pay a little bit more if you can.

Why do this? Because you are writing one check per month to pay four bills (three UMEs and one credit card payment). It’s just easier to do it this way because when you get paid you make that one large payment and you’re done.

In other words, you want to make as few bill payments as possible (from your checking account).

Using a Credit Card To Pay Bills Is Okay in Tiny Budgeting When …

You are carrying a balance on your credit card and you can pay it down while using it to pay other bills;

Your paycheck doesn’t come in time to make other bill payments on time;

You have been paying late fees and/or return check fees on your other bills;

You want to keep a card active so that your available credit gradually increases;

Your alternative is to take a short-term (payday) loan (which is very expensive).

Credit Cards are an Option, Not a Solution

Eliminating your debts as soon as possible is the best way to manage your finances. If you start relying on your credit cards to pay your monthly bills sooner or later you’ll start paying less money to the credit cards. Don’t fall into that trap. That just makes your situation worse.

Credit cards will get you through a couple of tough months. If you’re not paying the cards off every month or at least bringing the balances down you need to find another way to meet your monthly obligations.

You can use a credit to pay your bills as long as you pay off the card every month or your monthly balance continues to grow smaller.

The secret to getting out of debt is to manage your cash flow wisely. Sometimes it’s more expensive to avoid using a credit card than you realize. If you refuse to use a credit card to pay your bills before they start incurring late fees, you’re throwing money away. If, however, you use a credit card to pay your bills so you can have some cash to go gamble with, you’re doing it wrong.

Get out of debt first and build up your savings before you start finding ways to blow your money. Tiny Budgeting does allow you to spend some money on entertainment, but not at the expense of going deeper into debt. That defeats the purpose of using a Tiny Budget financial strategy.

In Tiny Budgeting You Only Use Credit for Necessary Expenses

Credit cards should not be treated as ways to fund your extravagant lifestyle. If you are putting money into savings, paying your bills, and still have some cash left over then you can spend that on whatever you wish. Tiny Budgeting is very flexible. All it requires is that you spend as little money as is necessary to meet your obligations.

Buying less expensive things to begin with is the Tiny Budgeter’s strategy. The less money you spend overall the less you will rely on credit to help you pay bills.

You want to use a credit card for convenience, not for necessity. It’s a convenience as long as you are not paying interest on your purchases, or you are reducing your monthly balance to zero.